One of the main risk management tools we have available to us, within the investment team, is the benefit of diversification. We do this by ensuring that our portfolios have a good spread across asset classes, geographies and economic sensitivities(1). To illustrate the current diversity within the funds, we thought it helpful to do a quick explainer on a few select holdings to provide a better understanding of how we are positioned.

Before jumping into the holdings, just a quick note on correlations.

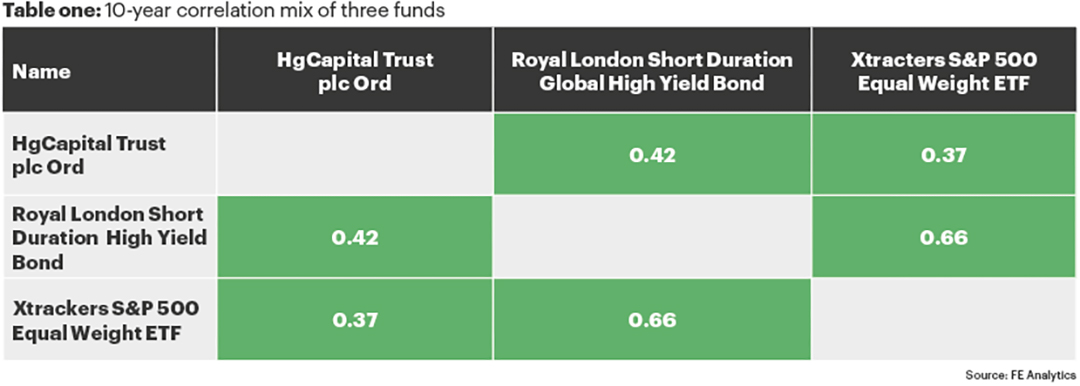

Correlations measure the relationship between two or more variables, ranging between -1 and +1. A correlation of +1 means two assets are perfectly correlated which means they will go up and down together. Correlation of -1 means the two assets will mirror each other, with one going down when the other goes up and vice versa.

Correlation data allows us to construct portfolios with parts that move differently to one another. This ensures we are not overexposed to certain risks and means we can expect certain segments of the portfolios to react differently in market stress situations.

By way of example, the 10-year correlation matrix table across the page is made up of three holdings, each of which we will go into more detail below.(2) As you can see, all the funds are positively (but lowly) correlated (numbers greater than 0), so we expect them to move in similar directions to one another, however, the extent to which they move will differ.

HG Capital

HG Capital is currently our favoured private equity holding. They are a UK based firm that invests in the software, technology and business critical sectors (the analytics programme that ran the illustrated correlation matrix is one of HG’s portfolio companies).

The general idea behind private equity is that they invest in non-public, generally smaller firms, which are capable from benefitting from the faster growth rates. They may then exit their positions through an Initial Public Offering (IPO), management buyout, secondary buyout (sale to another private equity firm) or strategic sale (sale to a competitor within the industry of the investee firm), at a return generally greater than those available within public equities.

HG think of themselves as a tech firm as much as they do a private equity firm, and have a strict focus on the sectors they will invest in. This focus on repeatable revenue, highly intangible asset businesses is one of their unique selling points and has been one of the key factors leading to their outstanding past performance.

Although we have alluded to the benefit of diversification, it would be fair to say a fund investing in a small number of fast-growing firms all within similar industries does not exactly tow the diversification line. However, all our holdings need to be considered within a portfolio context and HG serves as a good diversifier alongside our public equity holdings, defined returns and fixed income allocations.

S&P 500 Equal Weight ETF

The concentration within the US stock market is regularly discussed amongst the team, particularly the top end of the S&P 500 Index.

For those that are not too familiar with Index formation, the S&P 500 is the top 500 companies in the US, based on market capitalisation (share price multiplied by total number of shares in issue). This essentially means that as the share price increases, a company’s position in the index increases.

Therefore, if you hold a passive exchange-traded fund (ETF) tracking the index, your exposure to the company with the rising share price increases compared to the other holdings.

Currently the top 10 holdings within the S&P 500 make up around 34% of the index(3) and 43% of the index sits in the technology sector(4) which presents an element of concentration risk. We have therefore opted to diversify our US holdings by taking a position within the equal weight index, which, unsurprisingly, does exactly what it says on the tin. Its constituents are all held at equal weight, rather than by their position of market capitalisation weight. This undoubtedly reduces the concentration risk and assists in our mission for diversification.

Royal London Short Duration High Yield

Over the last 18-24 months, we have increased our fixed income position across most of our funds.

When increasing our weight in a certain asset class it is important that we do not become overexposed to certain areas of a market. Within fixed income, there are different factors such as credit qualities, maturities, coupons and interest rate sensitivities, therefore it’s important that we are not running any unintended overweight positions linked to these factors.

The Royal London Short Duration High Yield (RLSDHY), as explained in the name, focuses on two specific sectors of the fixed income markets – short duration and high yield. Duration is an estimation of a bond’s price sensitivity to a change in interest rate. In the case of Royal London, they currently have a duration of 1.1 which implies a 1% rise in interest rate would lead to a 1.1% fall in the bond’s price. For reference, market duration is around 6 years currently, therefore RL is much less interest rate sensitive.

The high-yield rating simply refers to the sub-investment grade part of the market, i.e. those borrowers who are deemed to be of higher risk by the market (see our related article – ‘Inside the world of high-yield bonds’).

It is our job to combine a selection of bond funds that meet the requirements of our fixed-income allocations within each of the Equilibrium funds. The RLSDHY is one of those building blocks, alongside other funds that have higher credit quality, longer duration and a different mix of fixed-income securities.

Conclusion

When constructing a portfolio, selecting funds that achieve diversification and have low correlation with each other (as shown in Table one) provides the advantage of performing differently across various market conditions, thereby reducing overall risk.

The above aside, diversification is not always suitable or necessary, it very much depends on the required outcomes of the investor. On top of this, there is such a thing called over[1]diversification, but maybe that’s one for the next edition of Equinox!

This article was featured in the autumn 2024 edition of our financial planning and investment magazine, Equinox. To download your free copy, click here.

If you have any further questions, please don’t hesitate to contact us. Clients can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This article is intended as an information piece and does not constitute investment advice.

Sources

(1) Diversification, Financial Conduct Authority, 2024.

(2) Equilibrium Investment Management, FE Analytics, 2024.

(3) iShares, 2024.

(4) Standard and Poors, 2024.