Please note: this newsletter was written before the government’s COVID-19 announcement on 22 September 2020, therefore any rules and regulations referred to around COVID-19 and social distancing may now be out of date.

Risk, return and viruses

Running an investment portfolio is all about managing risk and reward.

We are always looking at various investment opportunities and trying to find the optimum mix which will either:

- Maximise our return for a given level of risk, or

- Minimise our risk for a given level of return

There are often trade-offs which need to be made. For example, let’s assume we expect returns from the stock market to be above average. We might therefore want to hold more equities than usual.

However, equities are one of the riskiest asset classes, and so if we increase equity exposure, we are also increasing risk. We may therefore decide to reduce risk elsewhere in the portfolio to compensate for this.

For example, we may reduce exposure to corporate bonds (lending money to companies) and increase exposure to lower-risk government bonds or even cash.

We are all constantly making risk and reward judgements in our day-to-day lives, without even knowing it. Every time we cross the road, we are taking risk. When we’re in a hurry, we might rush across fast flowing traffic taking extra risk as we perceive a worthy reward in not being late!

Managing a pandemic

Right now, the government is making risk and reward judgements on a huge scale in trying to minimise the human cost of COVID-19 whilst maximising economic output.

Sometimes this leads to decisions that don’t make any apparent sense if we just consider the risk without also thinking about the return.

For example, we are now not allowed to meet more than six people that we might know and trust in our own houses. However, we are allowed to sit in a pub with 30 strangers where we have no idea how careful they are being.

We might perceive that going out for a pint is riskier, but it also has greater reward from an economic point of view. We would be spending money keeping a business going, which in turn means people keep their jobs, and the government makes some tax revenue, which in turn funds services etc.

If we assumed the two risks were the same, then it might make sense to allow the pub visit and not allow the home visit. Incidentally, there is some evidence from the track and trace service indicating that more transmission happens within homes than in public places.[i]

Virus management has some other parallels with investment management. When managing a portfolio the key is to make lots of small differences. For example, even small reductions in risk and cost and incremental increases in returns, if done consistently, can add up to a big number over time.

Wearing a mask has been controversial, but evidence is now pretty clear that they make a small but significant difference[ii] [iii]. So too does washing hands and keeping our distance. Apply all of these measures and it can make a significant difference to risk, but still allow us to go to work or go shopping (relatively) normally.

Health, wealth and happiness

Of course, economic benefits are not the only thing the government should be focusing on. The health (including mental health) and happiness of the nation are also of paramount importance.

We know that the seriousness of the virus is highly correlated with age[iv]. If we were purely looking to maximise economic output whilst looking to reduce the number of deaths or serious illness, we might simply tell all over 70s and those with health conditions to remain at home and everyone else to go about their business as usual! That would not be great for the mental health of those stuck at home or their families. It’s also not clear that it would work.

Sweden has tried a variant of this approach, imposing relatively few restrictions but with some efforts to shield older people, banning most visits to care homes for example[v].

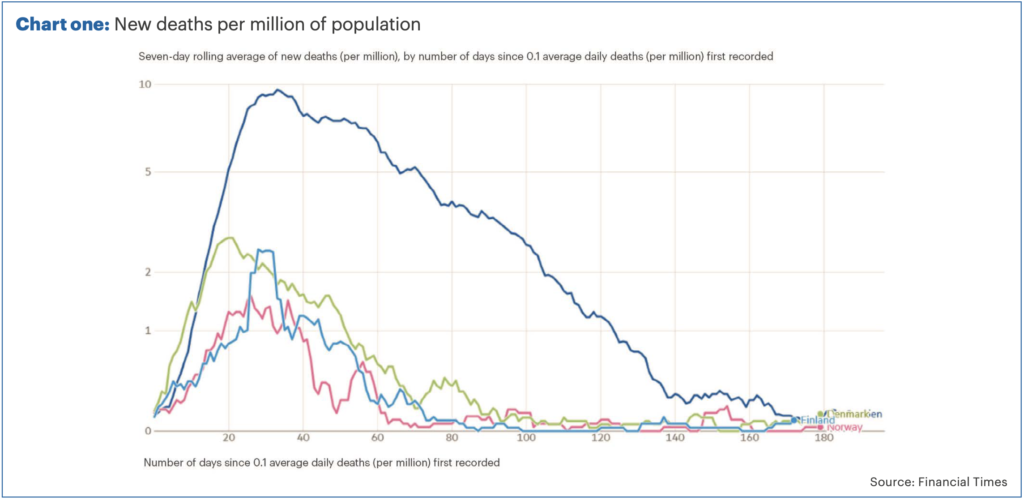

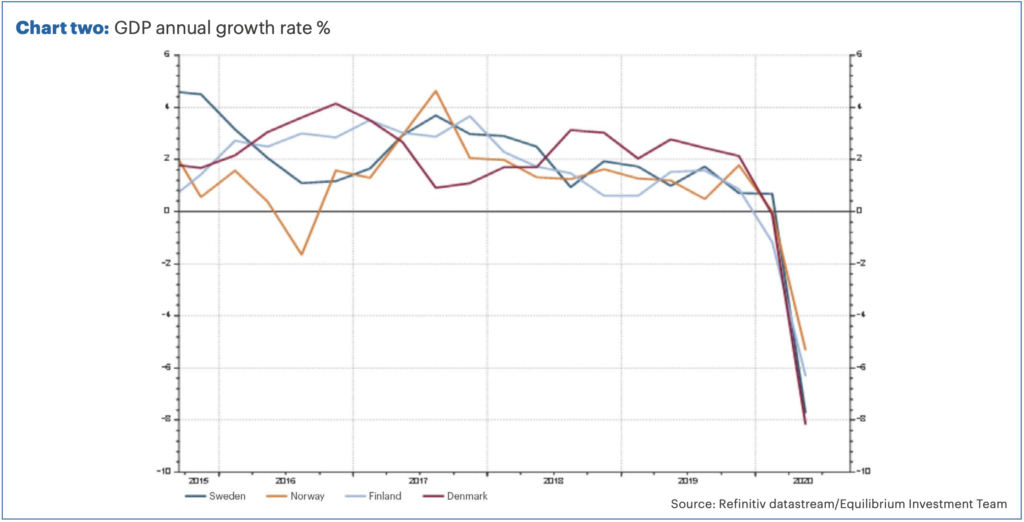

Cross-country comparisons are notoriously tricky and we should be wary about comparing economies with very different make-ups. However, we can reasonably compare Sweden to the other Nordic economies and, when we do, we see some striking differences.

Chart one shows that Sweden has seen substantially more deaths proportionate to its population than its neighbours and it has taken significantly longer for these numbers to come down. Perhaps this is not too surprising given that the other Scandinavian countries had strict lockdowns.

However, as chart two shows, the Swedish economy has been hit just as hard as their neighbours which is perhaps more unexpected. It turns out that when people are scared they stop going out as much even when they’re allowed!

Whilst the early signs aren’t great, in many ways it is too early to tell whether this approach has worked. Cases in Sweden have dramatically reduced in recent months, although this may be because many Swedes take long summer breaks away from the cities.

Whilst the rest of Europe may experience a second wave (and indeed may be already in one), perhaps Sweden will avoid it. However, so far there is little evidence they have built up the required level of herd immunity[i].

UK virus trends

At present, the number of virus cases in the UK is rising again.

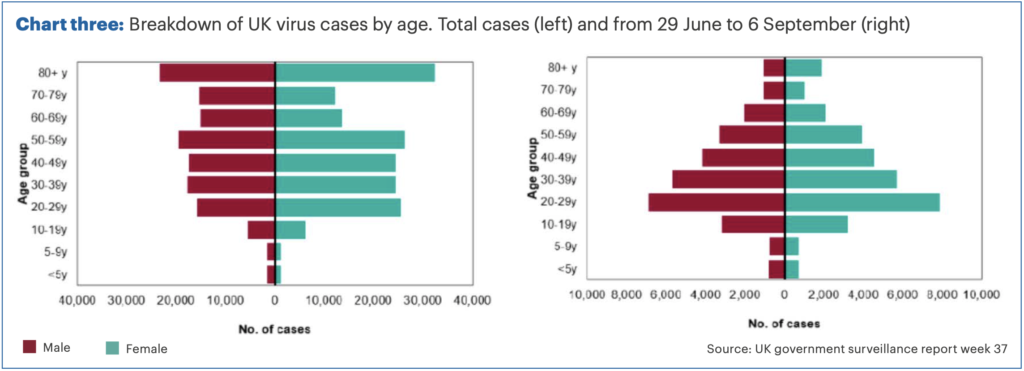

This is partly because we are now testing many more people and therefore capturing the more minor cases that have previously remained undiagnosed. Back in March, pretty much the only tests were done in hospitals and so, by definition, we were mainly capturing the more serious cases.

This partly explains why the current number of cases is increasing but the number of deaths has remained fairly flat.

Chart three shows the breakdown of cases by age. On the right are the numbers since end of June, whereas the left shows total number of cases. The largest bar in the left chart is in the over 80s, but right now the vast majority of positive cases are in the young, in particular the 20 to 29 year olds.

Whilst more tests are being carried out, the percentage of tests which are coming back positive are now also rising, and so this isn’t just a testing issue. The concern is what happens if those younger people pass the virus on to their older relatives etc.

Tipping point

Both from a virus and an economic point of view we may be at something of a tipping point. With schools back open and more people back in their workplaces, it is not surprising that cases are increasing. However, an increase in cases has possible economic consequences as well as medical.

Anyone who develops a cough or temperature now has to self-isolate – along with members of their family – until they can be tested. The testing system is currently experiencing many challenges and some people are having to wait for a long time for results.

I have personally had two members of my family (on separate occasions) develop symptoms just since the schools have returned. Both tests have thankfully been negative, but I am also lucky that I am able to work from home. Others don’t have that luxury and the impact on the economy of people being unable to work could be significant. The knock-on effects of teachers and NHS staff having to isolate for an extended period for example, could have a big effect on the nation’s health AND wealth.

The economy has been recovering well over the past couple of months, boosted by targeted VAT cuts and the Eat Out to Help Out scheme. The second quarter GDP growth is likely to be one of the best quarters ever (rebounding after the worst quarter ever). It is important we maintain momentum.

As well as a resurgence in the virus, a second risk we are concerned about at the moment is potential for rising unemployment. The furlough scheme is due to end on 31 October and right now we don’t know how many of those estimated 3.5 million[i] people will have jobs to return to.

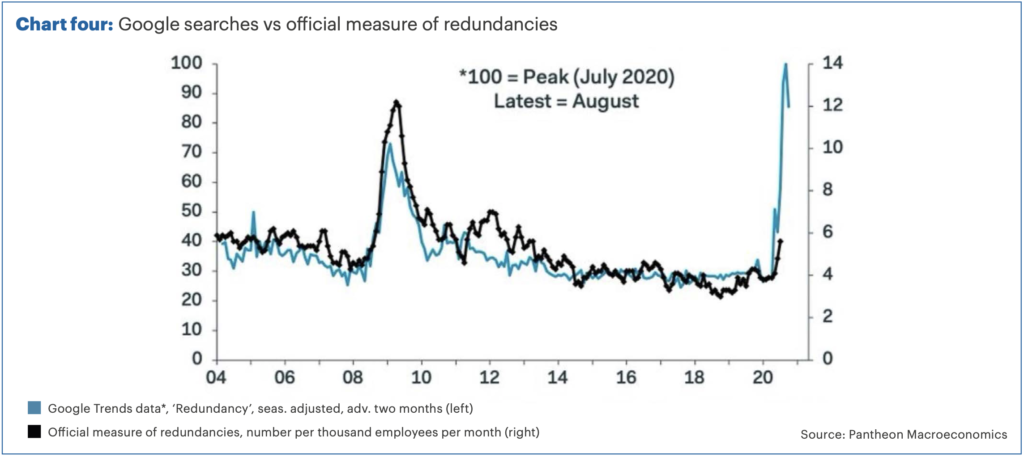

Chart four shows the official measure of redundancies (black line) which has been creeping up, although it remains far below 2008 levels for example. The blue line essentially shows the number of Google searches for the term “redundancy”.

There is historically a strong correlation between the two metrics, with Google trends appearing to be a good leading indicator. There has recently been a large spike in Google searches, indicating at least that many people are worried about losing their jobs.

Whilst we believe it most likely the economy will keep growing – if more slowly – the risk of a double dip is certainly a real one.

From an investment point of view we therefore need to be careful about taking too much risk, particularly around the more economically sensitive or “cyclical” areas.

However, as we’ve said previously there is also a risk in not having enough exposure to these cyclical stocks. Should there be a rapid improvement in testing, track and trace, or treatment (including potential vaccine), some beaten-up stocks could recover very rapidly.

As an aside, that could also lead to those stocks who’ve benefited from the work-from-home dynamic declining. Once again, it’s a fine balancing act.

Listen to the experts

There’s a lot of fake news doing the rounds surrounding the virus, as well as many sensationalist headlines in the mainstream press.

Therefore, where I’ve mentioned statistics or anything else in this newsletter, I’ve tried to make sure they are from reputable sources which can be found at the bottom of this page.

It goes without saying that we are not epidemiologists, virologists and have no medical background. We do, however, have some experience in analysing data!

In investment management, we go through cycles where we have to learn as much as possible about a particular topic that is affecting the markets in as short a time as possible. Prior to this, we had to learn about international trade and trade deals (which may well be necessary again shortly!).

We are not experts in such things, but our job is to listen to those who are, examine the data and make judgements about how this affects the risk and rewards for our portfolios.

For those who are interested, we recommend the government’s weekly COVID-19 surveillance reports and the Office of National Statistics’[i] if you want to view the underlying UK virus data yourself.

For a more entertaining analysis of the latest research, the BBC Radio show More or Less does a superb job in finding the facts behind the headlines.

Market views

General economic overview

Economies have generally seen strong growth in the third quarter, rebounding from sharp falls in quarter two. However, here in the UK and in Europe we are seeing an increase in coronavirus cases, whilst we still may see further job losses. Much still depends on whether a vaccine is produced or if other treatments become available.

In the UK, the risk of not concluding a trade deal with Europe before the end of this year is rising. Meanwhile, across the Atlantic we have a presidential election. The worst result might be a marginal victory for Biden if Trump refuses to concede.

Inflation is very low but could pick up sharply next year simply as a rebound effect. Despite this, we see no prospect of interest rates increasing in the near future. Indeed, the Federal Reserve currently expects to keep rates where they are until at least 2024

Stock markets no longer look cheap after a strong recovery combined with a fall in profits as a result of the virus. We still expect some positive returns over 18 months but perhaps more modest and with some potential volatility. We see most value in Asia and in UK smaller companies.

Fixed interest has had a very good run of returns recently and it is hard to see this continuing at the same pace. Yields on government bonds remain near zero, whilst high quality corporate bond yields have never been lower. There remains some value in higher yielding but higher risk bonds.

Property markets are in flux as the pandemic has hit retail hard, whilst the move to home working increases the uncertainty for offices. The FCA are consulting on whether to require notice periods on property funds. All of this makes property unattractive at present.

With interest rates remaining at record lows, returns on cash will remain close to zero. We retain higher cash balances than usual as protection against further market falls and have diversified this into different currencies.

For a typical balanced portfolio, we are roughly neutral on fixed interest and have very little property. We are underweight traditional equity but are instead holding more defined returns. The overall risk/return profile of our portfolios is slightly above long-term averages given our positive long-term equity outlook.

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times.

References

i https://www.gov.uk/government/publications/national-covid-19-surveillance-reports

ii https://www.ox.ac.uk/news/2020-07-08-oxford-covid-19-study-face-masks-and-coverings-work-act-now

iii https://www.ed.ac.uk/covid-19-response/latest-news/masks-block-spread-of-covid-linked-droplets

iv https://www.bmj.com/content/370/bmj.m3259

vi https://journals.sagepub.com/doi/full/10.1177/0141076820945282

vii https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2020/september-2020

viii https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/conditionsanddiseases