Executive summary:

- Artificial intelligence (AI) continues to transform industries, with notable advancements in autonomous AI platforms impacting sectors such as legal, professional services, and specialist software.

- While AI has driven phenomenal growth for some tech companies, recent market volatility has exposed risks, leading to sharp falls in share prices for firms potentially threatened by AI innovation.

- There has been a shift in stock market performance, with sectors like energy and materials outperforming technology, and markets such as the UK, Emerging Markets, and Japan showing stronger returns.

- Although AI is beginning to affect jobs in unexpected areas, overall unemployment remains stable, and UK productivity has seen significant growth, potentially due to increased AI adoption.

AI opportunities and threats

Over the past couple of years, investors have been enthused by the prospects for artificial intelligence (AI).

The share price of companies that are seen as beneficiaries have done phenomenally well. This includes the so-called “Magnificent Seven” big tech stocks, including companies that create AI such as Alphabet (Google), and the likes of Nvidia who sell the hardware needed to run the large amounts of data crunching required.

But while investors have focused on AI “winners”, they’ve not given so much thought to who might be the “losers”. Until recently.

Each new release of the major AI platforms has been a significant improvement on the past version, and the improvements seem to be getting larger. Partly this is because AIs themselves have become really good at computer coding. This means each iteration of the AI model can now help build the next version!

Recently, Anthropic released its new version called “Claude Cowork”.

This AI assistant was designed for legal and professional services. Essentially, it is designed to carry out various tasks autonomously from start to finish, without needing human input in between.

According to the Economic Times: “In demonstrations, the system independently conducted legal research and prepared filings, working from raw inputs.” In other words, it did much of the job without human intervention.

The fact that it can do these sort of tasks autonomously based on a few user prompts has massive implications across a wide range of industries. In particular, this could replace various specialist software such as customer relationship management (CRM) or data analysis systems.

Providers of such software like Salesforce (a CRM provider), and RELX (UK listed software and data analysis) dropped sharply. So too did providers of data analysis systems, such as London Stock Exchange (who we use to provide our data).

Since then, we have also seen sharp falls in the shares of commercial property companies like CBRE, logistics companies like DHL, and wealth managers like St James’s Place; all areas where new AI platforms are being released.

It seems investors are now beginning to understand there are investment risks as well as benefits to AI and are acting accordingly.

This has manifested in other ways, with both Microsoft and Amazon suffering 10%+ sell–offs recently. This is not because they aren’t doing well in terms of profits where both saw strong growth ahead of expectations.

Rather, the sell-off was because both said they were going to make even bigger capital expenditure commitments than expected on AI-related infrastructure.

Rotation and volatility

Most stock markets have continued to do well over the past few months. However, there’s been a lot going on under the surface of markets.

That’s because whilst some of the tech stocks have begun to underperform, which affects some markets more than others, other sectors have done very well.

According to Morningstar data, over the 3 months up to 6 February, the best sectors in the US were energy and materials (both up 22%), followed by industrial stocks and consumer staples (both up around 16%). Meanwhile the Technology sector was DOWN 3.7% over the same period.

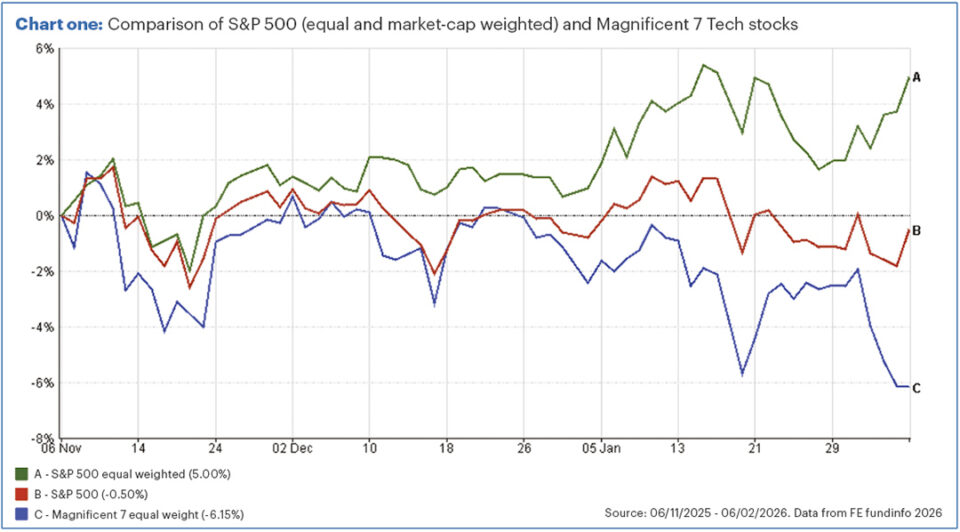

This is illustrated in Chart one. This shows two versions of the S&P 500 Index.

The standard version in red is what we call “market–cap weighted”, meaning it weights the position in the index according to the size of the company. The big tech stocks make up a large proportion of the index. This index is roughly flat in sterling terms over 3 months (the index has gone up, but the dollar has gone down).

The blue line on the chart represents the Magnificent 7 Tech stocks. They are down over 6%.

The green line is the equal-weight version of the S&P 500. Instead of putting more in the bigger companies, this one puts the same amount in each of the 500 stocks, regardless of size. That is UP 5% over the same period and saw strong growth at the exact same time the Mag 7 fell.

We hold an equal-weight S&P index tracker in portfolios alongside the more traditional index fund, because over the very long term, this approach has tended to see better performance. That has not been the case in the past few years due to the dominance of the tech sector, but perhaps that might be about to revert to longer–term trends?

We have also seen the US underperform other stock markets. In particular, markets in the UK, Emerging Markets and Japan have done much better, which again helps portfolios. Partly this reflects the makeup of those indices, with less in tech than the US and more in the other sectors which have outperformed.

Productivity and employment

A lot of people ask if AI is going to lead to mass unemployment. Unfortunately, even the best AI can’t accurately predict the future!

Let’s imagine a scenario where AI can do pretty much every job better than humans. What then happens to society?

There are two potential extreme scenarios. One is Utopia. Everyone has lots more leisure time because the robots are doing all the work. The benefits of AI are shared by all.

The second is nightmarish. The “robots” are doing all the workwork, and everyone is out of a job. But the wealth and benefits go to a small number of people or companies who own the robots. Basically, Elon Musk gets all the money in the world.

As usual, the reality is probably somewhere in the middle, but clearly, we need to think about this and legislate accordingly.

We are definitely starting to see an impact on some industries in terms of jobs, particularly in coding software as discussed, but also in industries you might not expect, including the arts and journalism. Just last week, the Washington Post announced it was laying off a third of its newsroom staff, partly because certain stories can now be written by AI. Illustrators and the like are finding less demand for their work.

However, overall unemployment remains low and stable. And of course, for those who can use AI effectively, productivity should increase.

In 2025, UK productivity (measured by output per worker) grew more than it did in the past seven years combined (according to calculations by the Resolution Foundation using ONS data).

There is much debate as to the reasons for this. Some attribute a lot of it to “creative destruction” where poor businesses go bust, leaving the better ones with greater market share. There has certainly been an increase in corporate insolvencies over the past couple of years, as interest rates and energy prices went up.

But it seems AI may also be having an impact on productivity already. As AI improves, many think the UK economy could be particularly well placed to benefit as we have a largely service-based economy.

As we’ve discussed in the past, an increase in productivity would be extremely helpful for government finances, as it should lead to greater economic growth, reducing debt to Gross Domestic Product (GDP) ratios.

At Equilibrium, we are definitely finding areas where AI is aiding productivity, for example in writing meeting notes, crunching data and providing analysis for our investment portfolios.

As AI improves, we think there are many tasks we will be able to do more quickly and easily, with less manual inputs, allowing us more time for other tasks and projects.

AI will have a significant impact and as, with all major developments, there are likely to be winners and losers. From a portfolio point of view, we continue to try and identify opportunities but we’re also aware of the threats and aware of the potential downsides as well as the possible gains.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute investment advice.

If you have any further questions, please don’t hesitate to get in touch with us on 0161 486 2250 or reach out to your usual Equilibrium contact.

New to Equilibrium? Call 0161 383 3335 for a free, no-obligation chat or contact us here.

Mike Deverell

Mike Deverell