Executive summary

- With stock markets predicted to be more volatile than in 2024, were equities navigating choppy waters or cruising on calm seas?

- Bonds and gilts have been treading water for a decade – so has the tide finally turned, or are they still stuck in the same current?

- Crypto never left the conversation – did Bitcoin sink as Mike forecast, or did it surge like the glory days of 2017?

- And with 2026 looming large, is it time to anchor back to fundamentals, or are we steering into truly uncharted territory?

In the run up to Christmas, all the major financial institutions release their predictions for the year ahead.

Also, at this time of year, I tend to go round explaining why these predictions aren’t worth the paper they are written on, and they should be largely ignored!

The Pulse from December last year looked in detail at how good the predictions from the previous ones had been – in short, not very good. Nobody has any special insight into the future. Unexpected events which impact markets happen all the time.

Despite that, I also made a few “predictions” of my own. Given I’ve spent plenty of time critiquing other people’s predictions, I thought it was only fair I looked back and saw how I did!

In last December’s the Pulse I predicted that:

- Stock markets will be volatile.

- The next 10 year returns for stocks will be worse than the previous 10 years…

- …but bond returns will be better than the previous decade.

- Bitcoin will crash at some point!

Stock markets will be volatile

Ok this is hardly a revolutionary statement! But sometimes it is worth reminding ourselves, particularly after a strong period for markets.

2024 had been a remarkably quiet year, with strong returns and with much less volatility than usual. I predicted that 2025 would be a bit less quiet.

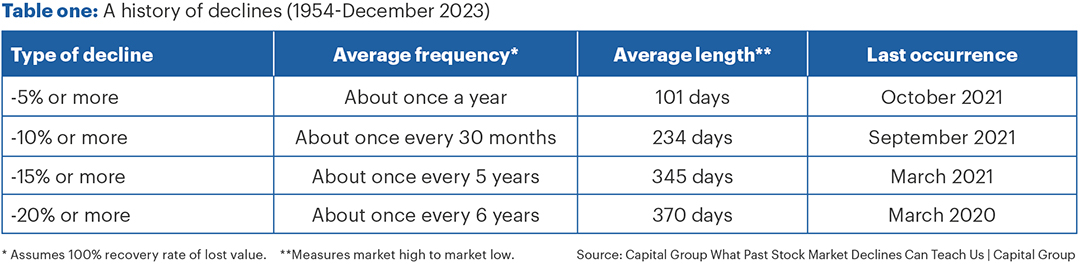

We shared Table one last year and repeat it again. This shows that 5% declines usually happen about once a year, and 10% declines about once every 30 months.

Markets go down 20% or more about once every 6 years on average (all this data is based on the main US market, the S&P 500).

I suggested that we might be overdue a large drawdown. And after President Trump revealed his tariffs on “Liberation Day”, that’s exactly what we got.

For sterling based investors, the S&P 500 fell by 22.15% from 23 January to 21 April (in dollars the maximum loss was a bit less at 18.75% – for UK investors the loss was bigger because the dollar fell too. Source: FE Analytics).

This was a handy reminder that the rewards of strong stock market returns come with a price; the risk of short term losses.

But it was also a good reminder that markets usually bounce back from such drawdowns. Sometimes it takes a good while, but sometimes it happens very quickly.

This time it was very quick, after Trump backed down on some (not all) of the tariffs, and despite the volatility the S&P 500 is actually UP this year by 10.97% (1 Jan to 5 December).

Verdict: correct

The next 10 years will be different to the previous 10 years

The 10 years up to end of 2024 was a pretty good one for equites. Again, taking the main US market (simply because a lot of the research we’re quoting focuses on the US) the return was well above average at 12.9% pa (10 years to 5 December 2024). It wasn’t so good for other markets, with the FTSE 100 (for example) growing a mere 6.1% pa over the same period (Source: FE Analytics).

However, it had been a terrible period for bonds, which fell a long way as interest rates rose in response to the cost of living crisis. We noted that gilts had returned essentially zero over the decade (actually -0.07% pa).

Last December, we predicted that the next 10 years would see much better returns for bonds, but that they would be a lot worse for stocks.

Clearly, we are only one year in and have another nine years before we can say if we were correct! But we can see how things are going so far…

As mentioned, the S&P 500 is up 10.97% in 2025 so far for Sterling investors. So far, so wrong!

For gilts, the return in 2025 up to 5 December is 4.78% (bang in line with expectations) and for corporate bonds it is 6.78% (slightly ahead of expectations).

The reason for my 10 year focus was to make my usual point, that investing is for the long term. Valuations are pretty important for the long term (but pretty much irrelevant in the short term).

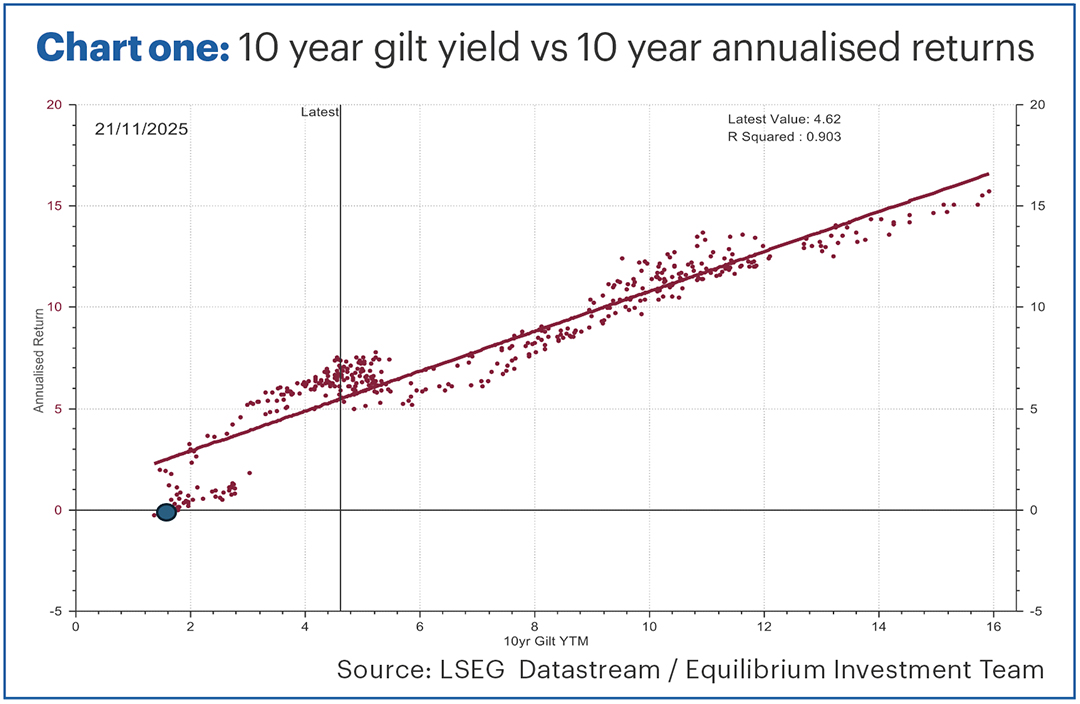

For gilts, the yield on the 10 year bond has historically been a very good predictor of 10 year total returns. This can be seen in Chart one which compares the historic 10 year returns on gilts to the yield at the beginning of each period (each dot is a different 10 year period in history).

Looking back 10 years to 2014, the yield was only 1.9%, making it likely that the return would be low over the following 10 years. This period is marked with the blue dot. Returns were perhaps slightly worse than we might have expected, but within the expected range.

This time last year, the yield was 4.3%, and so a 4.78% return so far this year means we’ve also got a capital gain from gilts on top of the yield. This might be somewhat surprising if you’ve seen some of the headlines about government finances this year!

The vertical black line shows where the yield is currently – about 4.6%, and in the past we’ve tended to see 4% to 6% pa returns when yields are at those levels.

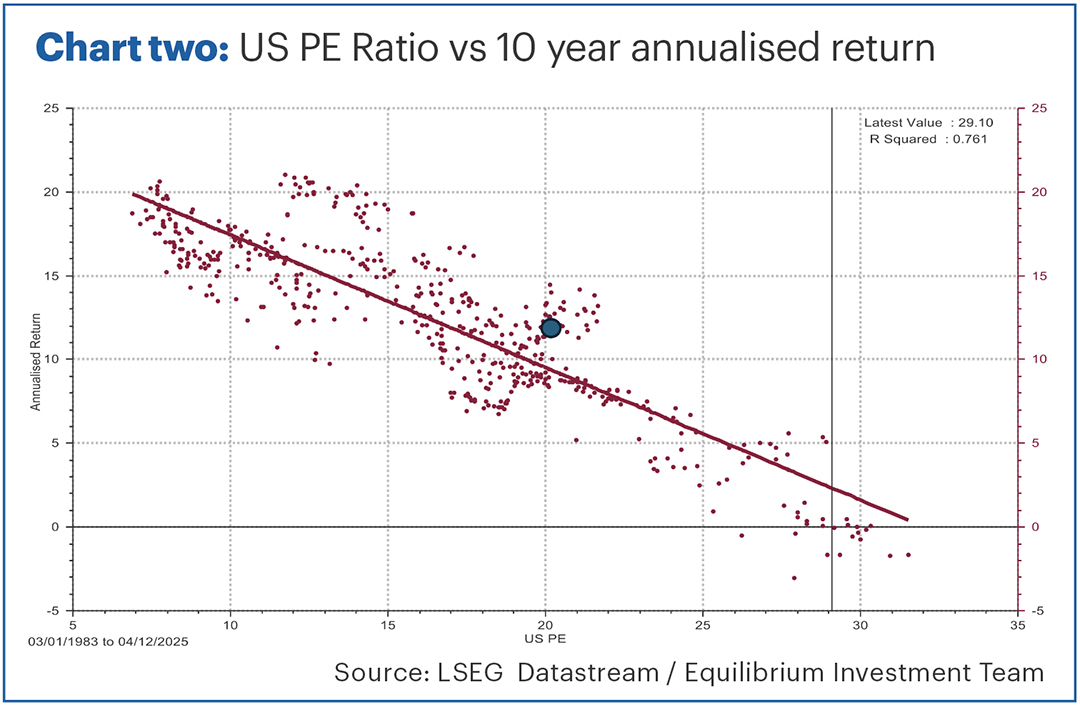

For equities, I made the point that the price/earnings (PE) ratio had historically been a good indicator of returns. Again, the blue dot on Chart two shows the 10 year period ending in 2024 – perhaps slightly ahead but generally in line with what would have been predicted by valuations.

I made the point that at about 30 times earnings, the US market was very expensive and typically we’ve seen very low returns when we’ve seen similar valuations before.

So where are we today, after the market has gone up so much?

The PE ratio is now 29 times earnings! Still expensive, but in fact slightly less than it was this time last year.

Why? It’s because earnings have gone up more than prices. Profits of the big tech stocks which make up such a big proportion of markets have grown strongly on the back of artificial intelligence.

Will this earnings growth continue? In our view, probably yes, for a while at least. Will it be strong enough for long enough to justify such a high multiple? We don’t know, but there’s a significant risk it won’t.

Our conclusion last year was that it probably made sense to allocate a bit more to bonds and a bit less to equities than we had done in the past. We still think that’s probably a sensible viewpoint and, even if equities are currently outperforming our expectations, so too are bonds (and with much less risk).

Verdict: for bonds, prediction is on track. For equities, currently off track. In truth, for both it’s too early to say!

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute investment advice.

1 Ponzi finance is an unsustainable funding structure that inevitably collapses when the flow of money stops.

If you have any further questions, please don’t hesitate to get in touch with us on 0161 486 2250 or reach out to your usual Equilibrium contact and we can help to maximise your entitlements.

New to Equilibrium? Call 0161 383 3335 for a free, no-obligation chat or contact us here.

Mike Deverell

Mike Deverell